My wife and I each make about $40,000 a year. If we file our taxes separately, can we each qualify for an exchange subsidy?

Q. My wife and I each make about $40,000/year. If we file our taxes separately, can we each qualify for an exchange subsidy?

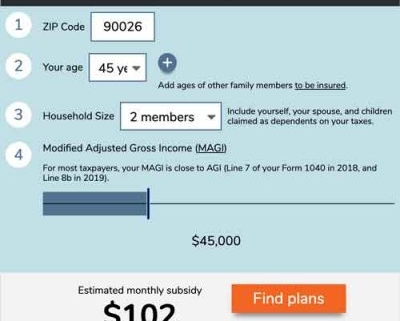

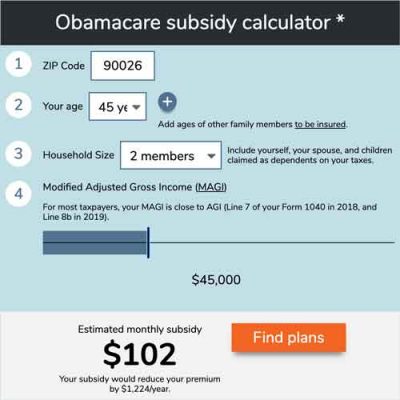

Use our calculator to estimate how much you could save on your ACA-compliant health insurance premiums.

A. No. The guidelines for eligibility are determined by total household income and the number of people in the household. For a single individual purchasing coverage with a 2021 effective date, the 400 percent mark is $51,040 in annual income (this is based on 2020 poverty level numbers, as the prior year’s numbers are always used). For two people, it’s $68,960. This makes sense, as it’s less expensive for two people to maintain one household than to maintain two separate households. Taxpayers whose filing status is married filing separately are explicitly ineligible to receive subsidies in the exchange, regardless of their income. (See this IRS publication for more details).

Premium subsidies have to be reconciled on your tax return, using Form 8962. If you receive a premium subsidy during the year and then end up using the married filing separately status, the full amount of the subsidy that was paid on your behalf would have to be repaid to the IRS with your tax return.

In March 2014, the IRS issued a special rule with regards to married people who are unable to file a joint return because of domestic abuse. If a taxpayer files as married filing separately, premium tax credits are still available as long as (1.) the spouses are not living together, (2.) the taxpayer is unable to file a joint return because of domestic violence, and (3.) the taxpayer indicates this information on his or her tax return.

For everyone else, the rules are clear that married couples must file a joint tax return in order to qualify for subsidies in the exchanges.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

The post My wife and I each make about $40,000 a year. If we file our taxes separately, can we each qualify for an exchange subsidy? appeared first on healthinsurance.org.