What to expect when you’re expecting health insurance premium subsidies

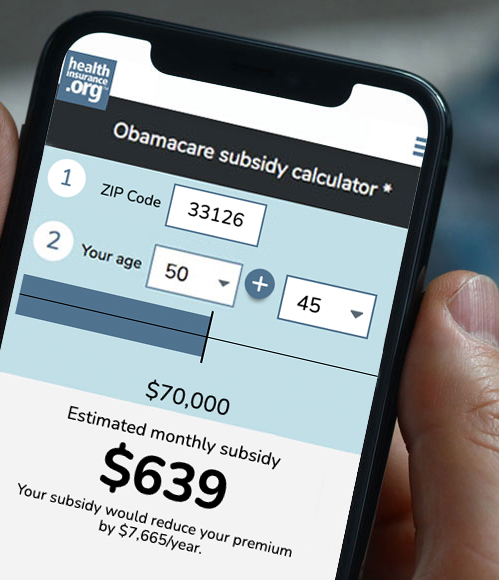

If you buy your own health insurance – or don’t have health insurance at all – you might have been pleased to hear that the American Rescue Plan (ARP) has increased premium subsidies for 2021 and made them available to more people.

But receiving those premium tax credits isn’t necessarily automatic: when and how you get them depends on where you live and other factors, including whether you’re already enrolled in a marketplace plan and whether you’re receiving unemployment compensation at any point in 2021.

The early bird gets the premium subsidy

Although the current COVID/ARP enrollment window extends through August 15 in most states, it’s in your best interest to enroll as soon as possible in order to maximize the number of months you get the extra subsidies.

If you’re receiving unemployment compensation at any point in 2021, the American Rescue Plan gives you access to substantial premium subsidies and full cost-sharing reductions. That means you’ll be eligible for a Silver plan that’s upgraded to better-than-platinum benefits, and you won’t have to pay any monthly premiums. But in most states, this benefit isn’t yet available. (Note that in some states, you may still have to pay a dollar or two, even for the lowest-cost Silver plans. And it’s worth noting that even if you’re eligible for a premium-free Silver plan, you might find that you prefer to upgrade to a Silver plan that has at least a nominal premium in trade for a more extensive provider network.)

Regardless, you’ll still want to enroll – or change your plan – as soon as possible so that when subsidies are available, you’ll receive credit for them.

Your state’s marketplace affects how and when you receive your subsidies

For starters, you should be aware that when it comes to how the ARP’s extra subsidies are being handled, there’s one process in the states that use HealthCare.gov, and 15 slightly different approaches in the other states. Thirty-six states use HealthCare.gov as their marketplace, while Washington, DC and the other 14 states operate their own state-run marketplaces (Covered California, New York State of Health, Your Health Idaho, etc.).

How and when will you receive your premium subsidy in a HealthCare.gov state?

If you’re in a state that uses HealthCare.gov, your additional subsidies will not be automatically added to your account, even if you already have financial information on file with the marketplace. You’ll need to log back into your account and follow the instructions to get your subsidy amount updated. (You can do this directly through HealthCare.gov or through an enhanced direct enrollment entity if you use one – or your broker or agent can help you sort it out). Once the new subsidy is determined, you can choose to either apply it to your current plan or pick a different plan.

If you’re uninsured or enrolled in an off-exchange plan, you can switch to the marketplace anytime between now and August 15. But the sooner you enroll, the sooner you’ll start receiving subsidies.

HealthCare.gov rolled out most of the ARP’s new subsidies as of April 1, but CMS has said it will be July before the enhanced subsidies are available to people who receive unemployment compensation in 2021.

It’s important to understand that regardless of the reason for the additional premium subsidy (including unemployment compensation), the subsidy itself is retroactive to January 1, 2021 in every state, as long as you’ve had coverage through the marketplace for the whole year. So even if your enhanced subsidy due to unemployment compensation doesn’t take effect until August, you’ll be able to claim the rest of it when you file your 2021 tax return. However, the full cost-sharing reductions for people who receive unemployment compensation in 2021 can only be provided in real-time, and won’t take effect until the marketplace can process them, starting this summer.

How will premium subsidies be treated in states that run their own marketplaces?

In the District of Columbia and the other 14 states, the deadlines, subsidy availability dates, and even eligibility rules differ from state to state. In most of these states, the current special enrollment window is functioning like an open enrollment period, with people allowed to newly enroll or switch plans – though there are some exceptions, detailed below. And in contrast to HealthCare.gov, nearly all of the state-run exchanges will be automatically updating subsidy amounts for current enrollees over the next several weeks, as long as the enrollee has financial information on file with the exchange.

Here’s a summary of what each state with a state-run marketplace is doing:

- Residents can enroll in an ACA-compliant plan through December 31.

- Subsidies are currently available for most people, but subsidy eligibility based on unemployment compensation won’t be available until July or August.

- For current enrollees, subsidies will be automatically updated in May.

- Residents can enroll in an ACA-compliant plan through August 15.

- Subsidies will not be automatically updated, but are currently available for both new and existing enrollees. The process will be more streamlined by mid-May.

- Residents can enroll in an ACA-compliant plan between May 1 and August 15.

- Subsidies will be available to most people starting May 1, although subsidy eligibility based on unemployment compensation will be available by July.

- Subsidies will be automatically updated by July, for current enrollees who don’t manually update their accounts before then.

- Residents can enroll in an ACA-compliant plan any time through the end of the pandemic emergency period.

- Extra subsidies are currently available to anyone eligible, including people who are eligible due to unemployment compensation in 2021.

- Subsidies will be automatically updated in May, for current enrollees who don’t manually update their accounts before then.

- For people who have been enrolled through the marketplace since January, the full amount of the additional premium subsidy will be spread across the remaining months of 2021 (as opposed to having to wait to claim the subsidy for the first few months of 2021 on their tax returns).

- Residents can enroll in an ACA-compliant plan through April 30.

- Updated subsidies are currently available, and have been automatically updated for existing enrollees who had already provided financial information to the exchange.

- Current enrollees can change plans, but only to another plan offered by the same insurance company (unless they have a qualifying event).

- Residents can enroll in an ACA-compliant plan through August 15.

- Updated subsidies are currently available, and will be automatically added to existing accounts as of May, for enrollees who have opted to receive the maximum available subsidy.

- Current enrollees with bronze or catastrophic plans can upgrade their coverage; current enrollees with Silver plans can switch to a more expensive Silver plan.

- Residents can enroll in an ACA-compliant plan through July 23.

- Updated subsidies are currently available, and will be automatically updated for existing subsidized enrollees as of May. Enrollees who are newly eligible for subsidies will be able to access them in May, for June coverage.

- As soon as possible, enrollees who have received any unemployment compensation in 2021 will become eligible for ConnectorCare Plan Type 2A, which has no monthly premiums and low out-of-pocket costs.

- Residents can enroll in an ACA-compliant plan through July 16.

- Updated subsidies are currently available, and MNsure will automatically update existing enrollees’ subsidy amounts if they have financial information on file.

- MNsure’s current enrollment window is only available to people who are uninsured or enrolled in a plan outside the exchange (it’s necessary to transition to the exchange in order to get premium subsidies). Current MNsure enrollees cannot use this window to switch plans unless they have a qualifying event. Minnesota and Vermont are currently the only states in the country with this restriction (Vermont plans to allow people to change plans in July).

- Residents can enroll in an ACA-compliant plan through August 15.

- Updated subsidies are currently available, and Nevada Health Link will start automatically updating existing enrollees’ subsidy amounts in June.

- Residents can enroll in an ACA-compliant plan through December 31.

- As of May, New Jersey is expanding its state-funded subsidies to include enrollees with household income up to 600% of the poverty level (this was previously capped at 400% of the poverty level)

- Updated subsidies are currently available. Existing enrollees can follow these steps to update their account, and new enrollees can follow these steps.

- The exchange will automatically update subsidy amounts this summer, for existing enrollees who haven’t yet taken action to update their subsidies.

- Residents can enroll in an ACA-compliant plan through December 31.

- Updated subsidies are currently available. This video shows how existing enrollees can update their subsidy amounts. New subsidy amounts will automatically be applied to eligible enrollees’ accounts as of June, if they haven’t taken action by then.

- Residents can enroll in an ACA-compliant plan through August 15.

- Updated subsidies are currently available. Pennie will apply them automatically by June, for existing enrollees who haven’t taken action to update their accounts by then.

- Residents can enroll in an ACA-compliant plan through August 15.

- HealthSourceRI has already automatically updated subsidy amounts for current enrollees with income up to 400% of the poverty level (ie, people who were already receiving subsidies are now receiving larger subsidies).

- For people with income above 400% of the poverty level, as well as people who are receiving unemployment compensation in 2021, the new subsidy amounts will be updated in June.

- Residents can enroll in an ACA-compliant plan through May 14.

- For now, Vermont’s marketplace is encouraging people who are uninsured or enrolled off-exchange to sign up for coverage through the marketplace as soon as possible.

- People who are receiving unemployment compensation are encouraged to call Vermont’s marketplace in order to begin the process of receiving additional subsidies.

- This summer, people will be able to log back into their accounts and update their subsidy amounts.

- Vermont, like Minnesota, is currently limiting the COVID/ARP-related enrollment window to people who are uninsured and people who have off-exchange coverage and need to transition to the exchange. A plan change for current on-exchange enrollees requires a qualifying event. But Vermont Health Connect confirmed that they plan to allow existing enrollees to make plan changes in July.

- Residents can enroll in an ACA-compliant plan through August 15.

- The additional subsidy amounts will be available by early May. Washington’s marketplace will automatically update existing enrollees’ accounts so that the new premium amounts take effect in June.

- People who enroll before May will not see the new subsidy amounts when they enroll, but their subsidies will be updated in May as long as they provide financial information to the marketplace when they enroll.

- Enrollees who do not currently receive tax credits may want to switch plans once they start receiving tax credits. They can log back into their account after May 15 to pick a different plan, as long as it’s offered by their current insurance company.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

The post What to expect when you’re expecting health insurance premium subsidies appeared first on healthinsurance.org.