50 populations whose lives are better thanks to the ACA

The Affordable Care Act (ACA) has faced numerous legal challenges, but has been upheld three times by the Supreme Court. Over the years, the headlines surrounding the possibility of the ACA (aka Obamacare) being overturned have often focused on people with pre-existing conditions who buy their own health insurance. (This is certainly a valid concern, as those individuals would undoubtedly be worse off without the ACA.)

But the impact of the ACA goes well beyond securing access to healthcare for people with pre-existing conditions. Who are these Americans, whose lives are better off, thanks to the ACA? See if you can find yourself – or your loved ones – in this list:

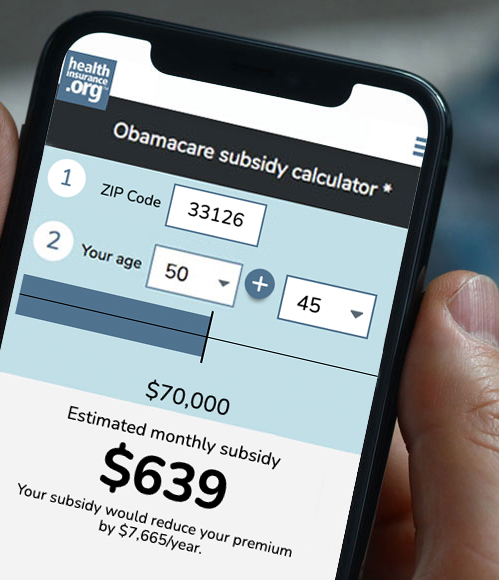

- More than 14 million Americans (91% of all Marketplace/exchange enrollees) who are receiving premium subsidies in the exchanges that make their coverage affordable. The average full-price premium is $605/month in 2023, but the average subsidy amount ($527/month) covers the majority of the average premium.

- More than 7.5 million people who are receiving cost-sharing reductions that make medical care more affordable and accessible.

- People who are (or want to be) self-employed and wouldn’t have been able to qualify for and/or afford a privately purchased health insurance plan without the ACA’s guaranteed-issue provisions and premium subsidies.

- People with pre-existing conditions who gain access to an employer-sponsored plan after being uninsured for 63+ days. HIPAA guaranteed that they could enroll in the employer-sponsored plan, but there were waiting periods for pre-existing conditions. The ACA eliminated those waiting periods.

- People who lose access to an employer’s plan and no longer have to rely on COBRA (or mini-COBRA/state continuation) for health coverage.

- People who gain access to an employer’s plan and have a waiting period of no more than 90 days before their coverage takes effect. Pre-ACA, employers could determine their own waiting periods, which were sometimes longer than three months.

- Full-time (30+ hours/week) workers at large businesses who are offered real health insurance instead of “mini-med” plans, thanks to the employer mandate. (Employers can choose not to comply, but they face a penalty in that case.)

-

People with serious conditions often exhausted their coverage under pre-ACA plan because of annual or lifetime benefits caps.

People with serious medical conditions who would otherwise have exhausted their coverage in the private market, including employer-sponsored plans. Pre-ACA, annual and lifetime benefit caps were the norm. And it could be shockingly easy to hit those maximums if you had a premature baby or a serious medical condition.

- Coal miners with black lung disease, and their survivors. The ACA made benefits under the Black Lung Benefits Act of 1972 available to more people.

- Medicare beneficiaries who use Part D prescription coverage and who would have ended up in the donut hole. before. (The ACA closed the donut hole as of 2020.)

- Medicare beneficiaries who receive free preventive care.

- American taxpayers and Medicare beneficiaries who benefit from ACA cost controls that have extended the solvency of the Medicare Hospital Insurance trust fund and improved Medicare’s long-term financial outlook.

- Seniors who are able to remain in their homes as they age, thanks to the ACA’s expansion of Medicaid funding for in-home long-term care services and supports.

- Nursing home residents – and people with loved ones living in nursing homes – who benefit from federal funding for background checks on employees who interact with patients.

- The 12 million low-income Americans who are elderly and/or disabled, covered simultaneously by both Medicare and Medicaid, and who benefit from the improvements the ACA made for the dual-eligible population.

- College students who are no longer offered skimpy health plans.

- Women (and their partners) who have access to contraception at no cost – including birth control methods such as IUDs, implants, and tubal ligations that are highly effective but would have prohibitively high up-front costs if they weren’t covered by insurance.

- Pregnant women who have access to free routine prenatal care.

- Expectant parents – male and female – who can enroll in a health plan in the individual market. (Pre-ACA, expectant parents’ applications were rejected in nearly every state.)

- People who buy their own health insurance and would like to have a child. Pre-ACA, individual health insurance rarely covered maternity care.

- Breastfeeding mothers who have access to breast pumps and breastfeeding counseling as part of their insurance benefits. The ACA also guarantees that breastfeeding mothers who work for large employers have access to adequate breaks and a private, non-bathroom area for pumping milk.

- Anyone who is better off in a world where people in need of mental health care can access it – because their health insurance covers it and they aren’t rejected altogether when they apply for a new health plan.

- People with substance abuse disorders who can obtain treatment that would be unaffordable without health insurance coverage.

- The 21 million people who have gained access to Medicaid thanks to the ACA’s expansion of coverage to low-income adults.

- Low-income families and individuals who no longer have to meet asset tests in order to qualify for Medicaid or CHIP, with eligibility now based on the ACA’s modified adjusted gross income instead (some populations, including the elderly and disabled, are still subject to asset tests for Medicaid eligibility).

- People in some rural areas of the country where hospitals have been able to remain open thanks to Medicaid expansion.

- Young adults who are able to remain on their parents’ health insurance as they work to start their careers.

- Young adults who were in foster care until age 18, and who are allowed to continue their Medicaid coverage until age 26, regardless of income.

- Early retirees who can enroll in self-purchased health insurance for the pre-Medicare years, without worrying about pre-existing conditions.

-

ACA’s marketplace plans must cover a list of vaccinations for children from birth to age 18.

Children who have access to free vaccines and well-child care.

- Adults who have access to a wide range of preventive health services at no cost.

- Families whose health plan covers their kids’ dental care.

- People in New York and Minnesota who earn a little too much for Medicaid but are eligible for coverage under Basic Health Programs (Oregon plans to debut a Basic Health Program in mid-2024).

- People who find themselves needing to appeal their health plan’s decision on a prior authorization request or claim.

- Medicare Advantage enrollees whose health plan is required to spend at least 85% of revenue on members’ medical claims and quality improvements.

- Individuals and employers whose insurers are required to spend at least 80% or 85% of premiums on members’ medical claims and quality improvements.

- People age 65 and older, including recent immigrants, who are able to enroll in ACA-compliant health plans if they’re not eligible for premium-free Medicare (pre-ACA, individual market insurers generally would not enroll people over age 64).

- Women, who no longer pay more for health insurance than men.

- Older people (including those age 65+ who aren’t eligible for premium-free Medicare), whose premiums are no more than three times as much as the premiums for a 21-year-old.

- People who buy their own health insurance and no longer have to worry that the policy could get rescinded because they forgot to mention something on the application. (This was usually due to an omission in the medical history section, and those questions are no longer asked – thanks, also, to the ACA.)

- Everyone who benefits from the more robust premium review processes that states have as a result of the ACA.

- Everyone who benefits from the ACA’s risk adjustment program, which levels the playing field and helps to prevent plan designs that would be unappealing to individuals and groups with high-cost medical conditions.

- People with individual and small-group coverage that includes all of the essential health benefits.

- People who pay full price for individual health insurance in Alaska, Colorado, Delaware, Georgia, Idaho, Maine, Maryland, Minnesota, Montana, New Hampshire, New Jersey, North Dakota, Oregon, Pennsylvania, Rhode Island, Virginia, and Wisconsin, who are paying lower premiums thanks to reinsurance programs that were implemented under Section 1332 of the ACA.

- Native Americans and Alaska Natives, who can enroll year-round in plans sold through the exchanges, and who are eligible for plans with zero cost-sharing if their income doesn’t exceed 300% of the poverty level. (That’s $90,000 for a family of four enrolling in 2024 coverage.)

- Native Americans and Alaska Natives who receive care via Indian Health Services – as the ACA permanently reauthorized the Indian Health Care Improvement Act.

- People who are protected from discrimination in healthcare based on race, national origin, sex, age, or disability, thanks to Section 1557 of the ACA. (The details of how these protections work are determined by HHS, so there have been some changes over time. HHS initially issued rulemaking in 2016, but it was rolled back in 2020. However, HHS proposed new rules in 2022 that would largely revert to the stronger anti-discrimination protections that were implemented in 2016.)

- People who are able to make more informed food choices thanks to nutritional and calorie information on restaurant menus. This stems from Section 4205 of the ACA, and was implemented in 2018.

- People who shop for coverage in the health insurance exchange and find the new star rating system for health plans to be helpful during the plan selection process.

- People who could benefit from new biosimilar drugs becoming available. Section 7002 of the ACA created the pathway under which biosimilar drugs are approved by the FDA.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.