How I sought to stop worrying and love a Bronze plan

Key takeaways

- For enrollees who don’t qualify for cost-sharing reduction, premium savings in a Bronze plan often outstrip out-of-pocket savings in a Silver plan.

- Tax-sheltered health savings accounts, available mainly with Bronze plans, increase premium subsidies.

- The psychological benefits of a lower deductible should at least be considered.

For many of the 155 million Americans who get their health insurance through an employer, the employer-sponsored plan feels like a security blanket. Look closely, as circumstances may well force you to, and the blanket may be full of holes. Tales of woe from patients who need intense care are plentiful – involving prior authorization hurdles, outright coverage denials for needed care or drugs, and until recently, surprise bills from out-of-network doctors or providers at in-network facilities (Congress at last banned most such billing in the No Surprises Act, effective January 1 of this year). High and rising deductibles, out-of-pocket maximums, and premiums also cause financial hardship for millions of mostly low-income workers.

Still, for the majority of employer plan enrollees whose plans cover about 85% of medical costs while the employer foots the lion’s share of the premium, the health insurance they have is not much of a worry. And people fear losing it.

That was my situation until this spring. While I am self-employed, my wife Cindy has worked at the same hospital for 25 years, which has provided family insurance. In that time we’ve been blessed with pretty good health, and when we’ve needed care, we’ve obtained it without significant hassle, including an operation to remove half my thyroid back in 2004.

Over the years our share of the premium crept up slowly, then jumped from about $200 a month to about $400 in 2016 when Cindy cut back her weekly work hours from 36 to 30 so she could help take care of her 90-something father. It’s now at about $450/month, which is manageable.

Into an ACA marketplace enhanced by the American Rescue Plan

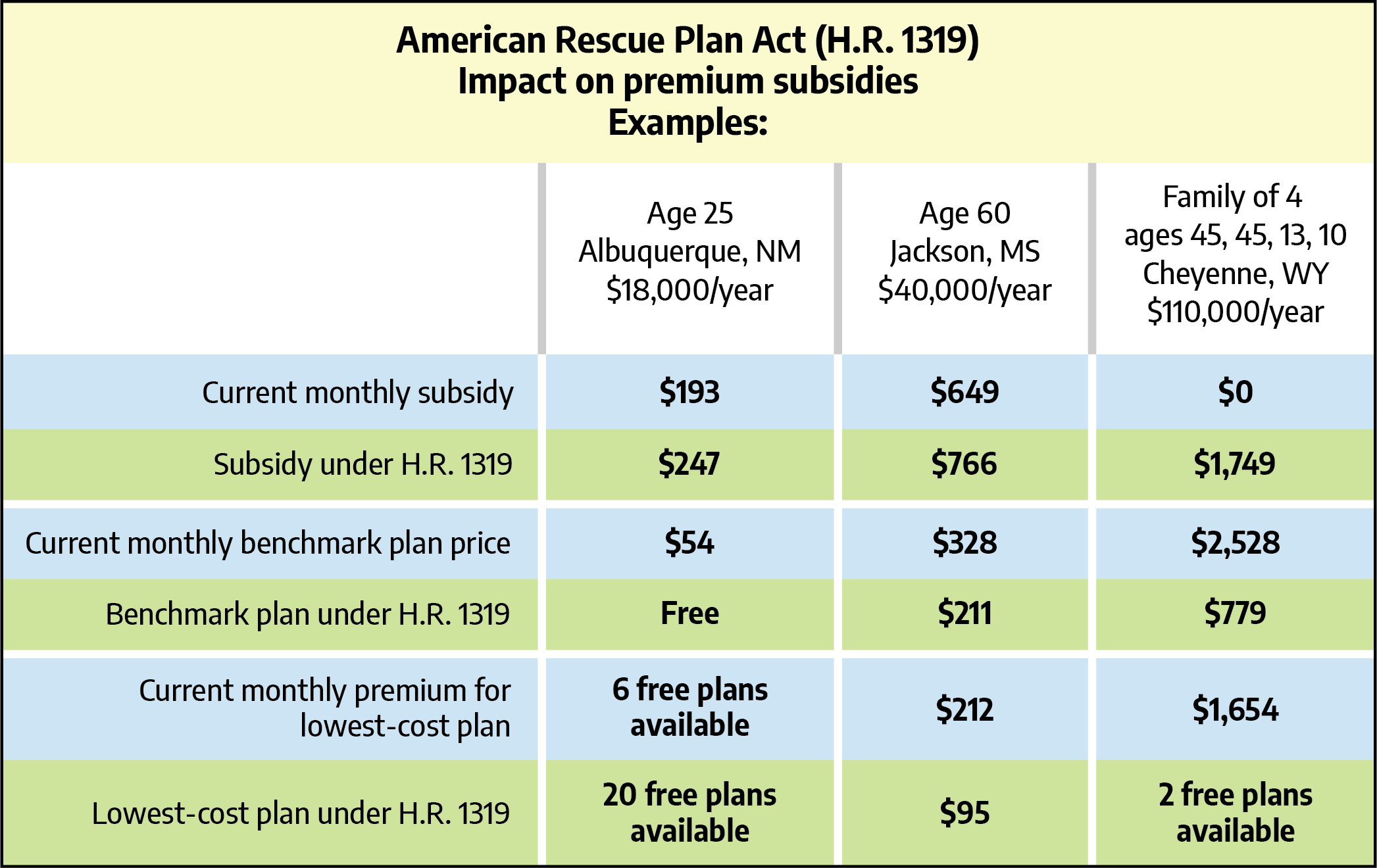

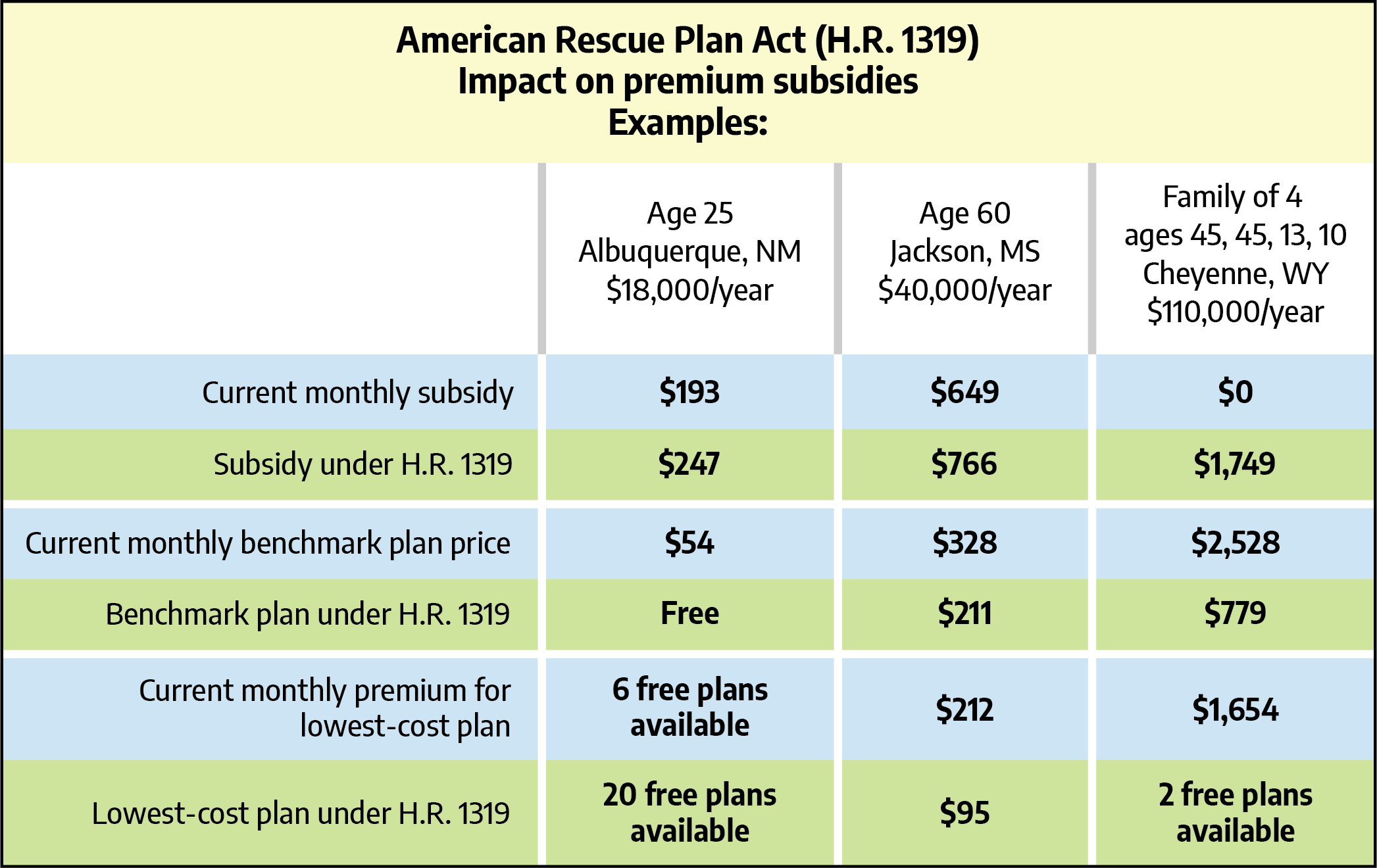

But change comes. Cindy is retiring this month, a little shy of her 64th birthday. The Affordable Care Act was supposed to make this feasible – and since March of last year, when the American Rescue Plan provided a major boost to premium subsidies in the ACA’s health insurance marketplace, the ACA has a far more credible claim than previously to reducing “job lock.”

The ARP subsidy boosts only extend through 2022. Democrats in Congress have intended to extend them further, but with their Build Back Better legislation long stalled, extension now is far from certain.

The ARP reduced the percentage of income required to buy a benchmark Silver plan (the second cheapest Silver plan in each area) at every income level, and it removed the notorious income cap on subsidies. Before the ARP’s enactment in March 2021, people whose family income exceeded 400% of the Federal Poverty Level – currently $51,520 for an individual, $106,000 for a family of four – were ineligible for premium subsidies. Since premiums rise with age – -at age 64, they’re triple what a 21 year-old pays – paying full freight was especially challenging for 60-somethings like Cindy and me. At our age, unsubsidized benchmark premiums are typically $700-800 per month – each – and more in some states (that’s also about what COBRA would cost us).

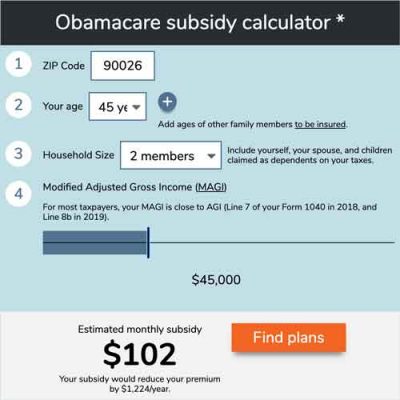

Now, thanks to the ARP, for anyone at any income level who lacks affordable access to other insurance, a benchmark plan costs no more than 8.5% of income, and much less at lower incomes (in fact, benchmark coverage is free up to 150% FPL). The measure that determines premium subsidies is modified adjusted gross income or MAGI – basically the AGI familiar to tax filers, with a handful of additional income sources (e.g., tax exempt interest) counted.

Thanks to the ARP subsidy boost, with a large payment to my individual 401k reducing our MAGI, Cindy and I can get a benchmark Silver plan for about $400 per month. And unlike in many states, here in New Jersey the plans offered by the dominant marketplace insurers have decent provider networks.

Choices in the New Jersey marketplace

|

|||

|---|---|---|---|

| Health plan | Monthly premium (after subsidy) | Deductible: single person | OOP max: single person |

| Lowest-cost Bronze (HSA) – AmeriHealth | $10 | $6,000 | $7,050 |

| Lowest-cost Bronze (no HSA) – Horizon BC | $255 | $3,000 | $8,700 |

| Lowest-cost Silver – AmeriHealth | $293 | $2,500 | $8,700 |

| Benchmark (second-lowest cost) Silver – Horizon | $404 | $2,500 | $8,700 |

| * Plans actively considered. Premiums are net of subsidy. Single-person deductibles and OOP maxes are double for the couple. | |||

What plan to buy? Comfort vs. math

Still, I am entering this individual insurance with some trepidation. Here’s why.

For years I’ve been closely observing and writing about the Affordable Care Act, on my blog, here at healthinsurance.org, and in various other publications. Brokers and other experts have drummed one salient fact into my head: For shoppers in the ACA marketplace with income over 200% FPL ($25,760 for an individual, $53,000 for a family of four), Bronze-level plans usually make the most economic sense. Bronze plans are the cheapest of four metal levels, and Bronze deductibles average over $7,000 for an individual, $14,000 for a family.

The picture is different for people with income under 200% FPL. Below that threshold, secondary cost-sharing reduction subsidies, available only with Silver plans and at no extra cost to the enrollee, reduce out-of-pocket costs to levels below those of the average employer-sponsored plans, making Silver the best choice for most low-income enrollees. CSR, which is strongest at the lowest incomes, reduces deductibles to an average below $150 at incomes up to 150% FPL and below $700 at an income in the 150-200% FPL. CSR weakens to near-insignificance at 200% FPL and phases out entirely at 250% FPL. While less than a third the population lives in households with income below 200% FPL, more than half of ACA marketplace enrollees do.

At higher incomes, Silver plan deductibles average more than $4,700, though in many plans a number of services, including doctor visits, are not subject to the deductible. That’s considerably lower than the Bronze average (over $7,000) – but generally not enough to justify the difference in premiums. That’s especially true because the annual out-of-pocket (OOP) maximum in Silver plans without CSR (that is, all Silver plans for people with income above 250% FPL) is generally not significantly below the Bronze plan OOP max. Both are usually north of $7,000 for an individual and often near or at the highest allowable, $8,700 per person.

Because premiums rise with age, the field tilts further toward Bronze plans for older enrollees. As the premium for a benchmark Silver plan rises, so does the subsidy, since all enrollees with the same income pay the same premium (a fixed percentage of income) for the benchmark plan. As the premium rises, so does the “spread” between the benchmark premium and cheaper plans. While my wife and I would pay $400 a month for benchmark Silver, we can get the cheapest Bronze plan on the market (from the same insurer) for about $10 per month.

Another consideration? HSAs

Still another factor points us toward that cheaper Bronze plan: it’s a so-called high deductible health plan (HDHP) that can be linked to a tax-sheltered health savings account (HSA). These plans, which are mostly Bronze-level, conform to special IRS rules. One is that they cannot exempt any services other than the free preventive screenings mandated by the ACA from the deductible ($6,000 per person in the Bronze plan we are likely to enroll in). That increases my anxiety: we’ll be paying cash for virtually all the medical care we access, unless we get ill or injured enough to hit the deductible. At the same time, HSA-linked plans, by statute, have lower out-of-pocket maximums than most Bronze or Silver plans, topping out at $7,050 per individual. That’s better than the two cheapest Silver plans, which both have OOP maxes of $8,700 per person. Finally, HSA contributions – up to $7,300 for Cindy and me – also reduce MAGI, and so the premium we will pay, as well as our taxes.

With the HSA contribution figured in (I left it out of my income estimate), the Bronze HSA plan we’ve settled on will probably ultimately be available for zero premium. The single-person maximum exposure, $7,050, is not much higher than what we pay in premiums in our employer-sponsored plans (about $5,400 annually) – or than what we’d pay for the benchmark Silver plan, which has a higher OOP max ($17,400 for two, vs. $14,100 for the HSA Bronze).

The cheapest Silver plan available would cost us about $300 per month, with a per-person deductible of $2,500. If both of us turn out to need a lot of medical care but not too much – say, $6,000 each – we could conceivably pay less on net under that plan, which pays 60% of most costs after the deductible is met, up to the OOP cap. But the odds of that are small. And again, if one of us needs tens of thousands of dollars in care – not unusual in U.S. medicine – we’ll pay less under the Bronze HDHP plan.

Psychological factors: it’s not cheaper if it kills you

The chief argument against a high deductible Bronze plan is psychological, but real. Some years ago, Dr. Ashish Jha, currently the Biden administration’s COVID-19 policy coordinator, tried a personal family experiment – enrolling in a high-deductible plan – and wrote up the results. Jha suffers from supraventricular tachycardia, a condition that makes his heart race periodically. One morning, he woke up with his heart racing, and it persisted for about a half hour. He knew that going to the ER would cost him thousands; he also knew that he would advise a patient to go. Instead he rode it out, and his heart calmed down. “I was lucky — I had rolled the dice and things had worked out,” Jha writes.

Cindy and I are both 63. That’s a bad age to be loathe to go to the ER – or to hesitate to get an unfamiliar twinge somewhere in our bodies checked out. Perhaps having money sequestered in an HSA will reduce the psychological resistance – those funds are dedicated to medical fees. But it’s still real money: if we don’t spend it, we can roll it into our retirement funds when we reach Medicare age. Being willing to spend it still requires a psychological adjustment.

If a Silver plan for $300 per month were our only choice, I’d probably be reasonably content. The prospect of paying next to nothing for an HDHP Bronze plan makes me nervous. But it’s hard to escape the math.

Assessing the ACA marketplace

Two things are notable about the private plans subsidized by the ACA as enhanced by the ARP. First, for almost all comers, plans with an affordable premium are available – in fact, Bronze plans with zero premium, or close to it, are available pretty high up the income ladder, especially for older adults. Second, out-of-pocket costs are high. At incomes over 200% FPL, it’s hard to avoid out-of-pocket maximums below $7,000 for an individual and $14,000 for a couple or family.

Why are out-of-pocket costs in these subsidized plans so high? Several reasons. First, American healthcare is just expensive – we pay almost triple the OECD average per capita, while using less care per capita than the OECD average. Second, to avoid all-out opposition to health reform from the healthcare industry (and in a failed attempt to win Republican buy-in), the Democrats who created the Affordable Care Act created a marketplace of private plans, paying commercial rates to providers – which average about twice Medicare rates for hospital payments and perhaps 130-160% of Medicare for physicians. Finally, healthcare scholars advising the ACA’s drafters believed that subjecting enrollees to high out-of-pocket costs – giving them ‘skin in the game” – was an effective way to reduce unnecessary care and so control costs (an idea substantially discredited by multiple studies indicating that enrollees faced with high out-of-pocket costs skip necessary as well as unnecessary care).

My wife and I are entering what two or three decades ago might have been understood as a moderate or even mainstream Republican health insurance utopia. We are paying close to nothing in premiums, and we are massively incentivized to save a huge chunk of our income in tax-sheltered accounts to keep it that way. The federal government is kicking in $1400 a month. We are on the hook for up to $14,100 in out-of-pocket expenses. If we’re healthy and don’t come near that threshold, we’ll pay cash for every medical service we access except for free preventive screenings.

I am very glad that the ACA was enacted and that Republicans failed to repeal it in 2017. (My personal welfare aside, the ACA’s core programs saved the country from a surge in the uninsured population during the pandemic.) As Cindy and I enter our life’s final quarter (or third, if we’re actuarially lucky), I’m grateful that affordable coverage is available in the hold-your-breath-till-Medicare years that will shield us from costs that could seriously impact our long-term financial health.

I can imagine a simpler and more cost-effective system – one that pays uniform rates to healthcare providers and offers a very short menu of affordable choices with low out-of-pocket costs to all Americans. But given the health system we have, and current political realities, my personal ask is more immediate and plausible: extend the ARP subsidy boosts. They’ve given the ACA a credible claim to live up to its name.

Andrew Sprung is a freelance writer who blogs about politics and healthcare policy at xpostfactoid. His articles about the Affordable Care Act have appeared in publications including The American Prospect, Health Affairs, The Atlantic, and The New Republic. He is the winner of the National Institute of Health Care Management’s 2016 Digital Media Award. He holds a Ph.D. in English literature from the University of Rochester.