6 lessons Mary Lou Retton’s health scare can teach us about coverage

On January 8, Olympic gymnast Mary Lou Retton attracted national attention and an outpouring of support when she appeared on the Today Show, explaining the health scare she faced in the fall of 2023. Retton recounted how she fell gravely ill with a rare form of pneumonia and – because she couldn’t afford health insurance – faced thousands of dollars in hospital bills.

The story fortunately has a happy ending: Retton was discharged from the hospital after about a month, and is recovering at home. And her daughters had organized a fundraiser that raised more than $459,000 in contributions. The family has confirmed that any funds beyond what’s needed for medical bills will be donated to charity. And Retton reports that she now has health insurance.

But to me, Retton’s story also included some important lessons for consumers, many of whom may assume that the celebrity’s health scare is a sign of barriers to affordable health coverage. Here’s what consumers can learn from Retton’s experience:

1. Having health coverage is critical.

Retton reported that her unexpected illness resulted in a month of hospital treatment, much of which was in the intensive care unit. With the per-day cost of a hospital stay in Texas averaging $2,913 in 2021,1 it’s easy to see how expenses can rack up quickly — and ICU costs are higher than regular inpatient care. Retton lives in Texas and was hospitalized there, but the national average cost is similar to the Texas average, at $2,883 per day for regular inpatient care.2

2. Pre-existing conditions are no longer a barrier to coverage.

On the Today Show, Retton pointed to previous health issues as a reason why she didn’t have coverage.

“When COVID hit and after my divorce and all my pre-existing (conditions), I mean, I’ve had over 30 operations of orthopedic stuff, I couldn’t afford it… But who would even know that this was going to happen to me?”

Unfortunately, that may leave some viewers with the impression that coverage might be unaffordable due to pre-existing medical conditions. In fact, medical underwriting hasn’t been used for individual/family health insurance policies since 2013.

For individual/family major medical policies with effective dates of 2014 or later, the insurer cannot take the applicant’s medical history into consideration. So pre-existing conditions will not affect the premium or the person’s eligibility for coverage. That was not true before 2014 in most states, but it has been true nationwide since 2014.

3. Enrollment windows are limited.

One possible reason that Retton didn’t have coverage is that she may have tried to enroll in comprehensive health coverage outside of open enrollment, and if she wasn’t eligible for a special enrollment period, she would have had to wait until open enrollment (with coverage effective in January).

Although coverage is guaranteed-issue regardless of medical history, enrollment in individual/family major medical plans is only available during open enrollment or a special enrollment period. This is the same as the employer-sponsored health coverage rules that have been used for decades.

4. Consumers in some states still face a coverage gap.

Retton, like many people in Texas, could be in the coverage gap, which exists because Texas has not yet elected to expand Medicaid under the Affordable Care Act (ACA). Texas is one of nine states where there’s a coverage gap, and an estimated 772,000 low-income Texas residents are in the coverage gap.

If a Texas resident’s household income is less than the federal poverty level, they’d be in the coverage gap, meaning they would not be eligible for Texas Medicaid or Marketplace premium subsidies.

It’s important to note that Marketplace premium subsidy eligibility is based on income, and assets are not taken into consideration. (Here’s how income is calculated under the ACA). So a person with considerable assets could still fall into the coverage gap in Texas, if their income is below the poverty level.

A person in the coverage gap can still enroll in Marketplace coverage, but will not qualify for any subsidies. Their decision to enroll in coverage will depend on whether they can afford to pay full price premiums.

5. Income affects subsidy eligibility.

On the other end of the spectrum, Retton’s income might have been too high to qualify for any Marketplace subsidies. Using HealthCare.gov’s 2023 plan comparison tool for a 55-year-old in her area, we can see that subsidies would have phased out at an income of roughly $98,000. (Subsidies phase out at the point where the price of the second-lowest-cost Silver plan becomes no more than 8.5% of the person’s household income, which is what the American Rescue Plan and Inflation Reduction Act consider affordable at that income level.)

If her income had been above that, she would have been paying full price for a plan, with 2023 premiums somewhere in the range of $501 to $1,075/month, depending on the plan. (These premiums are specific to Retton’s age and location; they will vary for other applicants).

6. But the income range for subsidy eligibility is wide.

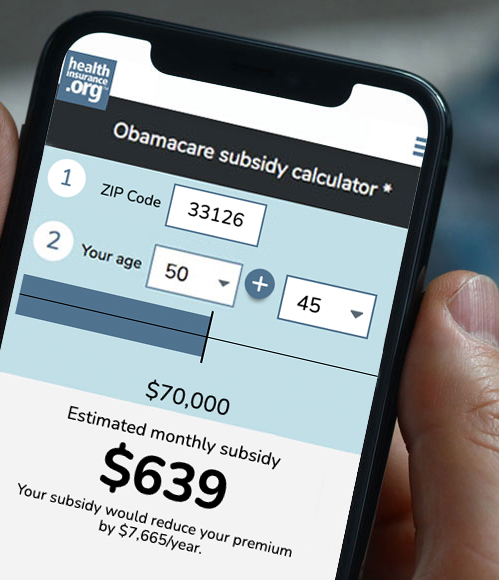

But if an individual Retton’s age and living in her area had a 2023 household income between $13,590 (the 2022 poverty level) and about $98,000 (the level at which subsidies in that case would have phased out altogether), they would have been eligible for Marketplace premium subsidies that covered some or all of the cost of the coverage, depending on where in that income range they were, and the plan they selected.

Although the ACA prohibits insurers from considering an applicant’s medical history, a person might not know about that if they haven’t had experience with purchasing coverage in the individual market in recent years.

And if a person hasn’t applied for coverage or used a subsidy calculator, they may not be aware of how substantial the premium subsidies can be in the Marketplace.

Ultimately, even an unsubsidized premium of several hundred dollars a month is a bargain compared with having to pay for a month-long stay in the ICU. But fortunately, most Marketplace enrollees do not pay anything close to the full amount of their premiums.

In 2023, the average full-price Marketplace premium in Texas was $578/month. But thanks to premium subsidies, the average enrollee paid just $65/month. And out of the 2.4 million Texas residents who enrolled in Marketplace coverage in 2023, more than 1.4 million were paying less than $10/month for their coverage.

I’m glad that Retton recovered and has secured health insurance going forward. These circumstances remind us that ACA-compliant health insurance can be obtained – regardless of our medical history, and with substantial subsidies available to most applicants.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Hospital Adjusted Expenses per Inpatient Day” KFF.org, Accessed January 2024

- “Hospital Adjusted Expenses per Inpatient Day” KFF.org. Accessed January 2024